Delivery time: 6 - 8 weeks

1 kilo

Delivery time: 6 - 8 weeks

1 kilo

€ 148.730,46 - € 148.790,46

Why choose a 1 kg gold bar?

A 1 kilogram gold bar is ideal for investors who want to convert a larger amount of wealth into tangible, stable precious metal. Due to the high purchase amount, this format is particularly suitable for those seeking long-term stability, protection against currency risks and inflation, or discreetly tradable wealth.

Many investors use these gold bars as a strategic reserve within their portfolio. They are also popular among wealthy individuals, family offices, and institutional investors. Thanks to their standardized form and global recognition, they are easy to verify and trade internationally.

The benefits of large-scale gold investments

One of the main advantages of a 1 kg gold bar is the relatively low premium per gram. Compared to smaller bars, you pay less on top of the current gold price. This makes the purchase more cost-effective. The larger the bar, the lower the storage costs per gram tend to be. This makes investing in a kilo of gold extremely efficient, especially for long-term investors.

In addition, a gold bar of this size offers high value density. A substantial amount of wealth is concentrated in a compact, manageable object. This not only simplifies storage but also makes transport more straightforward and discreet. You do not need a large vault to safely store a serious investment.

For investors who want to hold physical gold without compromising on storage convenience or tradability, the 1 kg gold bar is an excellent choice. You maintain maximum value, packaged in a practical and globally recognized format.

Which brands offer 1 kg gold bars?

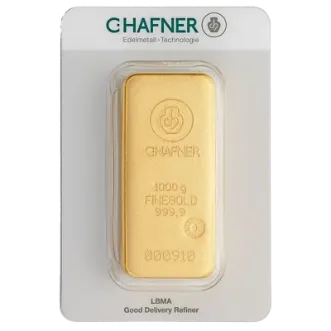

Several renowned producers supply 1 kilogram gold bars of outstanding quality. Some well-known names in the market include Umicore, C. Hafner, Valcambi, PAMP Suisse, and Argor-Heraeus.

These producers have built a strong global reputation and are among the most trusted providers of investment gold. They deliver gold bars that consistently meet the strictest quality standards. The bars are easily traded worldwide at virtually all reputable precious metal dealers. All of the mentioned brands are accredited by the London Bullion Market Association (LBMA) and produce their gold bars according to the Good Delivery standards.

These guidelines require, among other things, that each gold bar is at least 99.99% pure and meets fixed specifications for weight and dimensions. In addition, each bar must be clearly identifiable with an official stamp showing the mint’s logo, a purity indication, and a unique serial number. Thanks to these uniform features, the bars are easy to recognize, verify, and trade worldwide.

As a result, investors benefit from maximum security: the origin is traceable, the quality is guaranteed, and the gold bars are accepted worldwide without difficulty. A 1 kilogram gold bar from an LBMA-accredited brand therefore represents not only value but also direct liquidity and trust in the international market.

Buying 1 kg gold bars at Bitgild: how it works

If you want to buy 1 kilogram gold bars, Bitgild guarantees a simple and secure ordering process. In the webshop, you select the desired brand or type of gold bar, place your order, and then choose a payment method. Bitgild accepts several payment options, including bank transfer, credit card, and cryptocurrencies such as Bitcoin or Ethereum.

Once the payment has been processed, you will receive a confirmation. The gold bar will then be shipped insured and discreetly. With a track & trace code, you can follow the delivery right to your doorstep. Do you have questions or specific requests? Bitgild’s customer service is ready to provide you with personal and expert advice.

Price development of 1 kg gold: what you need to know

The price of a 1 kilogram gold bar is directly linked to the current international gold rate. This fluctuates daily based on global supply and demand. Various economic factors such as inflation expectations, interest rate developments, and geopolitical tensions also influence the gold price.

When confidence in the markets declines, investors often turn to gold. This increases demand and typically drives the price upward. Historically, gold has proven to be a stable store of value, especially during times of economic instability or financial uncertainty.

For investors buying 1 kilogram gold bars, this context provides important insights. By closely monitoring market developments and entering strategically, one can benefit from price movements. Over the long term, investors can thus achieve an attractive return.

Safe storage and insurance of large gold bars

Due to their significant value, it is important to store a 1 kg gold bar in a safe and controlled way. A certified fire- and burglary-resistant safe at home is a good option for those who want direct access to their precious metal. It is essential, however, that the storage environment meets specific safety standards.

For extra security, many investors choose external storage in a specialized precious metals vault. These professional facilities offer advanced security, climate control, and full insurance in the name of the owner.

Bitgild actively advises clients in finding a suitable storage solution, tailored to their investment objectives, risk profile, and accessibility preferences. In addition to physical security, proper management of related documentation is also important. Therefore, always keep the certificate of authenticity, purchase receipt, and any serial number registration in a separate, secure location.

Order today, insured and discreetly shipped

Bitgild has several 1 kilogram gold bars directly in stock. If you order on a working day, your order will usually be shipped within a few business days. The packaging is neutral and contains no indication of contents or sender. Every shipment is insured against loss or damage during transport. This way, you can be sure that your investment is delivered to you safely and confidentially. Buying gold at Bitgild means certainty, quality, and speed—from order to delivery.